What is Cryptocurrency Staking?

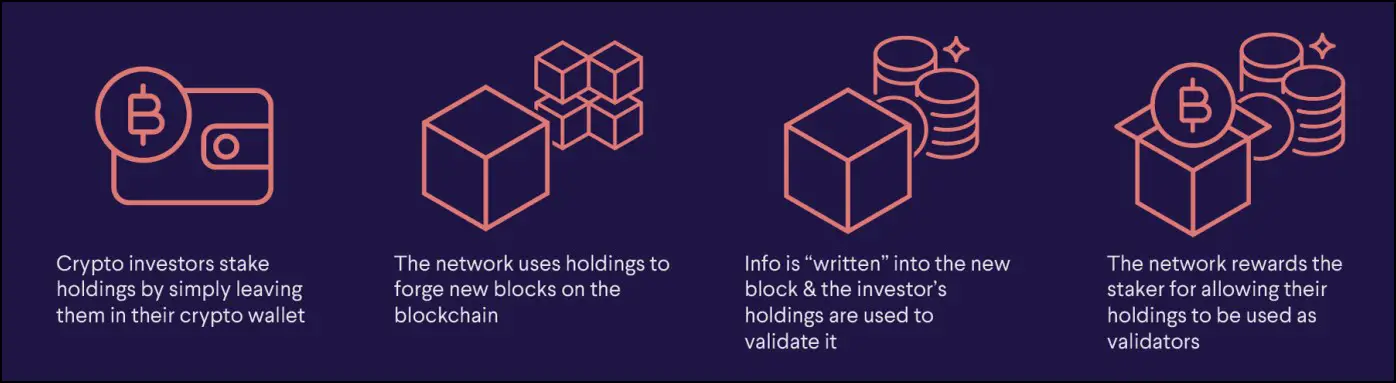

In traditional finance, we used to deposit funds in our bank account, and the bank will use the funds to lend them out to other users who needed financial assistance. In return, the bank would give us a tiny reward for lending in the name of interest. Imagine the same scenario in cryptocurrencies. Here, instead of money, users will lock their crypto assets for a fixed duration to take part in making the blockchain function and maintain its security. As a reward, a percentage of the yield will be provided to the holders. And guess what? This percentage will always be higher than the interest rates offered by conventional financial institutions. Therefore, staking has become one of the most lucrative strategies to make good returns in the crypto ecosystem.

To dig deeper, every blockchain network will have a consensus mechanism. It all began with Proof of Work, where high computational power is required to solve the puzzles to validate the transactions on the blockchain. Gradually, to make it energy-efficient, Proof of Stake was introduced. Here, the native currency of the network has to be locked up. Depending upon the number of coins a validator stakes, the algorithm will allow the owner to validate the blocks. For every right task, a reward will be shared, and, at the same time, for any wrong validation, a percentage of the stake will be confiscated.

The Factors that Influence Staking Rewards

There is no hard and fast rule to calculate the shaking rewards. Mostly, the rewards will be distributed on a block-by-block basis. But some of the primary factors include,

The number of coins that a validator stakesThe duration of stakingTotal number of coins staked on the networkInflation rate

Apart from this, many other factors might also affect the staking protocol.

Popular PoS Crypto Assets that Allows you to Stake

The following are some of the reputed crypto assets with Proof of Stake as their consensus mechanism.

Ethereum 2.0 (ETH): Even though Ethereum follows the Proof of Work mechanism, the upgraded version of the network, Ethereum 2.0, has a PoS algorithm. Any individual can become the validator of the network by simply staking 32 ETH and downloading a specific software that allows them to access the network. When the required conditions are met, they can validate the transactions on the blockchain.Cardano (ADA): Being a third-generation blockchain, Cardano has its own sets of smart contracts and incentivizes the network through its native currency, ADA. Users can stake ADA to declare their votes on the network (for verifying the transactions) and gain rewards for every right validation periodically. Emurgo’s Yoroi wallet or IOG’s Daedalus wallet is the most commonly used wallet to stake ADA.Solana (SOL): SOL is the native currency of the Solana blockchain network, and reports from Statista depict that SOL is the most staked currency in March 2022. The network has designed its smart contracts to allow developers to deploy decentralized applications (dApps) easily. Users can take part in the network as delegated stakers or validators and earn exciting rewards.Polkadot (DOT): Polkadot is the network that is best known for its interoperable nature. It believes that the future is interoperable. It also allows users to participate as validators through a NPoS (Nominated Proof of Stake) algorithm. Here, validators are responsible for verifying transactions, and nominators ensure the proper functioning of the network. So both nominators and validators are eligible to stake DOT.

Q. What Are the Ways Through Which I Can Stake Crypto Assets?

The different ways of staking crypto assets include:

Crypto Exchange: One of the best options for staking cryptocurrency is to open an account on a crypto exchange, preferably a centralized exchange. It does not involve any complications, and you can stake assets easily. The rewards for your staking will be paid out at regular intervals.Staking Pools: Staking pools are the next popular method to stake crypto assets. Here, the assets have to be locked for a fixed duration. The maximum benefits can be availed if the assets are not taken out until the set duration.Validator Staking: As discussed above, any network that has a Proof of Stake algorithm can stake its native currencies to validate transactions and ensure the network’s security.

Q. What Are the Risk Factors in Cryptocurrency Staking?

Not all coins are the same. Staking coins that have a high inflation rate is quite risky. This is because, initially, they might have high returns, but in the long-term vision, they might fail. Also, they must have proper real-time utilities. It is only these utilities that will help in increasing the price of the asset in the future. Staking in assets that do not have ideal utilities may provide low returns.

Q. What Are the Most Common Crypto Assets That Are Used for Staking?

Cryptocurrencies such as USDT, BNB, AXS, SHIB, MATIC, AVAX, ADA, SOL, etc., are commonly staked by investors as these assets provide a high APY.

Q. What Are the Different Types of Crypto Exchanges That Allow Staking?

Some of the top exchanges that allow you to stake assets include Binance, Kraken, Coinbase, Kucoin, Crypto.com, Gemini, etc. Sign up in your favorite exchange to start staking your crypto assets rather than keeping them idle in your wallet.

Wrapping Up

Cryptocurrency staking is one of the phenomenal passive income solutions to make your money work for you while you sleep. If you have never tried staking before, that’s absolutely fine. But now, you know what staking is all about, so don’t even waste a single day. Go, stake your asset right away, and start earning your passive income!